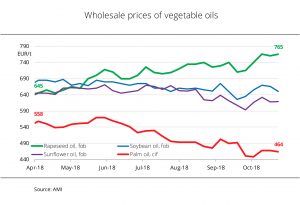

The price difference between rapeseed oil fob Germany and palm oil cif Rotterdam rose from 87 EUR/t to more than 300 EUR/t between April and the end of October. Agrarmarkt Informations-Gesellschaft mbH (AMI) last noted such an unusually large gap in December 2012.

The main reason for this uneven price development lies in differing supply-side trends: rapeseed oil is in demand and is scarce due to low harvest levels; palm oil supply, on the other hand, is plentiful.

Blenders continue to show unabated interest in purchasing rapeseed methyl ester biodiesel due to its better winter properties. Even if demand is likely to calm down by the end of the year, there will still be a shortfall to be filled, which will provide market impetus. Smaller rapeseed harvest yields are just one of the factors that have caused prices to rise. Water levels on the waterways have also been low for weeks, pushing up freight costs for seed delivery, as well as for transport of products, especially rapeseed meal.

In contrast, demand for palm oil has gradually weakened and hit a three-year low at the end of October. This was triggered by rising inventories in producer countries as a result of scant exports. Production was at times lower than during the same period last year. In addition, production rises seasonally in the second half of the year, with volumes likely to even be significantly higher than last year. Companies in the food and chemical industries that process palm oil will benefit from this downward price trend.

In contrast, demand for palm oil has gradually weakened and hit a three-year low at the end of October. This was triggered by rising inventories in producer countries as a result of scant exports. Production was at times lower than during the same period last year. In addition, production rises seasonally in the second half of the year, with volumes likely to even be significantly higher than last year. Companies in the food and chemical industries that process palm oil will benefit from this downward price trend.

The Union for the Promotion of Oil and Protein Plants (UFOP) notes that market price differentiation between palm oil certified as sustainable and non-certified palm oil has not yet become established in market price quotations. The industry platform “Sustainable Palm Oil Forum” (FONAP), supported by the Federal Ministry of Agriculture, recently rightly complained about sluggish development in particular concerning sustainable palm oil for material use, still with a 27% share of this market, despite an oversupply of certified palm oil. The UFOP raises the question of whether sustainable palm oil production is even possible at 464 EUR/t, particularly if social criteria are factored in.