[UA] – The numbers that are shared in the article below reflect the situation as it was in January 2021. The analysis of the economic and aviation indicators Uniting Aviation shares here reflect the continuing impact of Covid-19 on this industry.

The air transport industry is not only a vital engine of global socio-economic growth, but it is also of vital importance as a catalyst for economic development. Not only does the industry create direct and indirect employment and support tourism and local businesses, but it also stimulates foreign investment and international trade.

Informed decision-making is the foundation upon which successful businesses are built. In a fast-growing industry like aviation, planners and investors require the most comprehensive, up-to-date, and reliable data. ICAO’s aviation data/statistics programme provides accurate, reliable and consistent aviation data so that States, international organizations, aviation industry, tourism and other stakeholders can:

- make better projections;

- control costs and risks;

- improve business valuations; and

- benchmark performance.

The UN recognized ICAO as the central agency responsible for the collection, analysis, publication, standardization, improvement and dissemination of statistics pertaining to civil aviation. Because of its status as a UN specialized agency, ICAO remains independent from outside influences and is committed to consistently offering comprehensive and objective data. Every month ICAO produces this Air Transport Monitor, a monthly snapshot and analysis of the economic and aviation indicators.

Economic Development – March 2021

.1. Passenger traffic

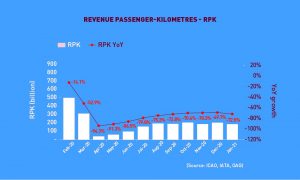

Revenue Passenger-Kilometres – RPK

World passenger traffic fell by -72.5% YoY in January 2021, -2.8 percentage points lower than the decline in the previous month. Entering into the new year, the pandemic intensified across the globe, with the emergence of more contagious virus variants and the imposition of stricter control measures. Consequently, 2021 started with a worsening decline in passenger traffic, the first deterioration since bottoming out from the lowest point of the crisis in April. Domestic traffic was mostly impacted, particularly in China where traffic plunged due to the tightened travel restrictions.

Available Seat-Kilometres – ASK

Capacity worldwide fell by -59.3% YoY in January 2021, -2.6 percentage points down from the decline in the previous month (-56.7%). Amid the surge of new COVID-19 cases and increasing travel restrictions, capacity is likely to stay at a similar level as in February 2021 with a decline of -57.7% YoY.

Load Factor

The passenger Load Factor reached 54.1% in January 2021, -3.4 percentage points lower than the previous month. As air travel demand fell faster than capacity, the January LF deteriorated to the lowest level since May 2020, and was -26.2 percentage points lower than the rate in the same period of 2020.

.2. Freight Traffic

Freight Tonne-Kilometres – FTK

World freight traffic reported a growth of +6.1% YoY in January 2021, +6.6 percentage points up from the fall in the previous month. After experiencing 21-month of continuous YoY decline since April 2019, freight traffic finally saw positive growth and exceeded the 2019 levels. Despite the renewed outbreaks, air cargo demand remained robust supported by the recovery in economic activities, and strengthening in manufacturing and goods trade. Air cargo demand improved in all regions, particularly in Africa and North America where traffic has expanded double-digitally. The Middle East also grew solidly, while Latin America/Caribbean posted the weakest performance and was the only region recording negative growth.

More data: Click here to download the complete Monthly Monitor March PDF version.